All About Financial Education

Wiki Article

What Does Financial Education Mean?

Table of ContentsFacts About Financial Education RevealedThe Best Strategy To Use For Financial EducationThe Financial Education DiariesThe Only Guide for Financial EducationNot known Facts About Financial EducationSome Known Facts About Financial Education.9 Simple Techniques For Financial EducationNot known Details About Financial Education Little Known Questions About Financial Education.

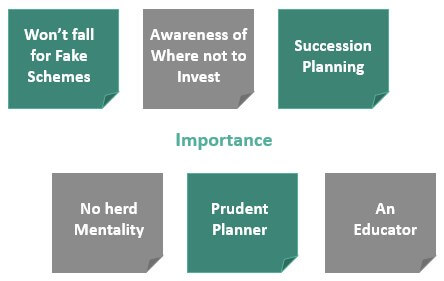

Without it, our financial choices as well as the actions we takeor do not takelack a solid structure for success.With each other, the populations they offer span a wide range of ages, earnings, and histories. These educators witness first-hand the effect that economic literacyor the lack of monetary literacycan have on an individual's life.

Financial Education - An Overview

Our group is pleased to be producing a brand-new paradigm within college by bringing the subject of cash out of the darkness. We have actually come to be national leaders in our field by verifying that personal economic education and learning solutions are no much longer an exception for today's studentsthey are an expectation.", Director, Student Money Administration Center at the College of North Texas "I assume at a very early age, or perhaps later in lifeif they have actually made inadequate choices yet learn how they can go back and also repair them and begin intending for the future.", Supervisor of Financial Education And Learning, Virginia Lending Institution "Finances inherentlywhether or not it's unbelievably temporary in simply purchasing lunch for that day or long-lasting conserving for retirementhelp you complete whatever your objectives are.Each year given that the TIAA Institute-GFLEC study began, the average percentage of questions answered properly has increasedfrom 49% in 2017 to 52% in 2020. While there's more work to be done to inform consumers concerning their finances, Americans are relocating in the right instructions.

Excitement About Financial Education

Don't let the anxiety of delving into the monetary globe, or a feeling that you're "simply not excellent with cash," stop you from improving your financial knowledge. There are tiny steps you can take, and also sources that can help you in the process. To start, make the most of complimentary devices that might currently be available to you.Several banks as well as Experian additionally supply free credit rating tracking. You can utilize these devices to obtain a preliminary understanding of where your money is going and where you stand with your credit score. Discover whether the business you work for deals totally free economic counseling or an employee financial health care.

The 3-Minute Rule for Financial Education

With a good or excellent credit history, you can receive lower passion rates on lendings and charge card, bank card with attractive and also money-saving rewards, and a variety of deals for economic items, which gives you the opportunity to select the most effective bargain. But to boost debt, you require to understand what variables contribute to your score. Best Nursing Paper Writing Service.This new circumstance is resulting in greater uncertainty in the financial setting, in the financial markets and also, certainly, in our very own lives. Neither should we fail to remember that the dilemma resulting from the pandemic has actually examined the of agents and families in the.

Financial Education for Beginners

As we pointed out previously, the pandemic has actually also boosted using digital networks by people that have not always been electronically as well as economically empowered. Furthermore, there are additionally sectors of the population that are less aware of technical breakthroughs as well as are for that reason at. Contributing to this trouble, following the pandemic we have additionally seen the reduction of physical branches, specifically in country areas.Among the best gifts that you, as a moms and dad, can provide your kids is the cash talk. As well as similar to with that said other talk, have a peek at this site tweens and teenagers aren't always responsive to what parents have to saywhether it has to do with consent or substance interest. Yet as teenagers come to be a lot more independent and consider life after secondary school, it's simply as crucial for them to find out regarding financial proficiency as it is to do their very own laundry.

Facts About Financial Education Revealed

Knowing index how to make sound cash decisions currently will certainly aid give teens the confidence to make much better choices tomorrow. Financial proficiency can be specified as "the capacity to make use of knowledge and skills to handle monetary sources properly for a life time of economic health." Simply put: It's recognizing how to save, expand, and safeguard your money.And like any kind of ability, the earlier you discover, the more mastery you'll get. There's no much better location to speak about practical cash abilities than at house, so kids can ask questionsand make mistakesin a risk-free area. No one is more interested in youngsters' economic futures than their parents.

Financial Education Can Be Fun For Anyone

By educating children regarding money, you'll help them learn how to balance wants and needs without entering into financial obligation. Older teens may wish to go on a journey with friends, but with also a little economic internet proficiency, they'll recognize that this is a "desire" they might need to budget plan as well as save for.

Some Known Incorrect Statements About Financial Education

, instead of giving an automated "no," aid them comprehend that it's not totally free cash.

Not known Incorrect Statements About Financial Education

Report this wiki page